Executive Summary

Indonesia’s construction industry achieved lower-than-expected growth rates in the first quarter of 2011, prompting us to downwardly revise our full-year real growth forecasts for the sector to 6.3% in 2011 (previously 7.4%). We believe that this weaker growth is due to the rising cost of inputs and the fact there has been no resolution with regard to problems with regulatory issues in the construction sector. While the rate of inflation is likely to ease in the second half of this year, regulatory issues are unlikely to be resolved quickly, and this could have ramifications for the growth potential in the construction sector over the long term. Nevertheless, construction activity, driven by investment into transport and energy infrastructure, as well as industrial construction related to the country's growing mining sector, is expected to be relatively robust between 2012 and 2015, averaging 7.3% per annum.

Reference

Indonesia Infrastructure Report Q4 2011, © Business Monitor International Ltd.

22 Agustus 2011

07 Agustus 2011

Indonesia Infrastructure Report Q3 2011

EXCEUTIVE SUMMARY

BMI View: Indonesia’s construction industry has been experiencing exceptionally high levels of inflation over recent years; however, despite this trend real growth has been high, averaging 7.6% per year between 2003 and 2010. Although these high levels of inflation are expected to continue over the forecast period (2010-2015), the construction industry is still anticipated to post high real growth, reflecting the high levels of anticipated activity. This is being driven by investment into transport and energy infrastructure, as well as industrial construction related to the country's growing mining sector. In 2011 we are forecasting construction industry growth of 7.4%, and between 2011 and 2015 we are forecasting growth to average 8.1% per year.

Key factors that will facilitate growth include:

�� The Indonesian government is looking at issuing Islamic bonds to meet its financing needs. In January 2011, Bloomberg reported that the finance ministry had proposed to the Indonesian shari'a board – Majelis Ulama Indonesia – that revenues from new road and rail projects (due to be built over the next three years) should be used to repay Islamic bonds.

�� In December 2010, Japan signed a Memorandum of Cooperation (MoC) with Indonesia for the development of around US$24bn worth of infrastructure projects in the Jakarta Metropolitan Priority Area (MPA). However, the recent devastation wrought by the Tohoku Pacific earthquake that hit Japan on March 11 2011 has raised significant uncertainty about the future destination of Japanese investment and the project could now be delayed.

�� In March 2011, the Indonesian government announced that it may offer 16 infrastructure projects worth US$32bn to investors in April 2011. These 16 projects are to be offered under a public private partnership (PPP) framework and would focus on a wide variety of infrastructure developments; ie toll roads, bridges, railways, seaports, power plants, water treatment facilities and cruise terminals. However, only five of the 16 projects are currently ready for investment.

Indonesia’s business environment remains a downside risk for investors. Although the Indonesian government is working hard to attract private investors, there is still an underlying threat of corruption and a lack of transparency in infrastructure tenders. The biggest concern is that Indonesia appears to be regressing in its fight against corruption, with a raft of proposals – that if approved – would undermine current anti graft laws. This culminates in a score of just 55.6 out of 100 for infrastructure business environment.

Reference

Indonesia Infrastructure Report Q3 2011

BMI View: Indonesia’s construction industry has been experiencing exceptionally high levels of inflation over recent years; however, despite this trend real growth has been high, averaging 7.6% per year between 2003 and 2010. Although these high levels of inflation are expected to continue over the forecast period (2010-2015), the construction industry is still anticipated to post high real growth, reflecting the high levels of anticipated activity. This is being driven by investment into transport and energy infrastructure, as well as industrial construction related to the country's growing mining sector. In 2011 we are forecasting construction industry growth of 7.4%, and between 2011 and 2015 we are forecasting growth to average 8.1% per year.

Key factors that will facilitate growth include:

�� The Indonesian government is looking at issuing Islamic bonds to meet its financing needs. In January 2011, Bloomberg reported that the finance ministry had proposed to the Indonesian shari'a board – Majelis Ulama Indonesia – that revenues from new road and rail projects (due to be built over the next three years) should be used to repay Islamic bonds.

�� In December 2010, Japan signed a Memorandum of Cooperation (MoC) with Indonesia for the development of around US$24bn worth of infrastructure projects in the Jakarta Metropolitan Priority Area (MPA). However, the recent devastation wrought by the Tohoku Pacific earthquake that hit Japan on March 11 2011 has raised significant uncertainty about the future destination of Japanese investment and the project could now be delayed.

�� In March 2011, the Indonesian government announced that it may offer 16 infrastructure projects worth US$32bn to investors in April 2011. These 16 projects are to be offered under a public private partnership (PPP) framework and would focus on a wide variety of infrastructure developments; ie toll roads, bridges, railways, seaports, power plants, water treatment facilities and cruise terminals. However, only five of the 16 projects are currently ready for investment.

Indonesia’s business environment remains a downside risk for investors. Although the Indonesian government is working hard to attract private investors, there is still an underlying threat of corruption and a lack of transparency in infrastructure tenders. The biggest concern is that Indonesia appears to be regressing in its fight against corruption, with a raft of proposals – that if approved – would undermine current anti graft laws. This culminates in a score of just 55.6 out of 100 for infrastructure business environment.

Reference

Indonesia Infrastructure Report Q3 2011

06 Maret 2011

Daftar Rencana Topik Penelitian S2 (Magister)

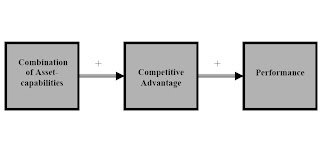

Berikut ini adalah daftar rencana topik-topik penelitian untuk tugas akhir atau thesis untuk program magister (S2) pada program magister "manajemen konstruksi" atau "manajemen proyek" :

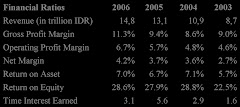

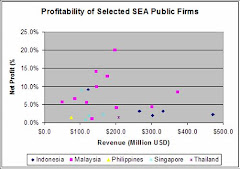

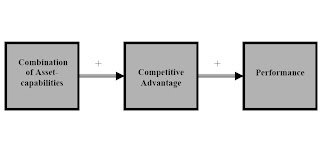

1. Asset dan Kapabilitas Teknologi dalam hubungannya dengan keunggulan bersaing dan kinerja lestari perusahaan

2. Asset dan Kapabilitas Inovasi/Komplementer dalam hubungannya dengan keunggulan bersaing dan kinerja lestari perusahaan

3. Asset dan Kapabilitas Keuangan dalam hubungannya dengan keunggulan bersaing dan kinerja lestari perusahaan

4. Asset dan Kapabilitas Reputasi dalam hubungannya dengan keunggulan bersaing dan kinerja lestari perusahaan

5. Asset dan Kapabilitas Struktur dalam hubungannya dengan keunggulan bersaing dan kinerja lestari perusahaan

6. Asset dan Kapabilitas Institusional dalam hubungannya dengan keunggulan bersaing dan kinerja lestari perusahaan

7. Asset dan Kapabilitas Pasar/Posisi dalam hubungannya dengan keunggulan bersaing dan kinerja lestari perusahaan

Rencana penelitian ini merupakan lanjutan dari studi penelitian dari disertasi tentang manajemen strategik pada perusahaan konstruksi di Indonesia yang mengacu kepada paradigma strategi bisnis yaitu kapabilitas dinamis (dynamic capabilities framework) yang digagas oleh David Teece (1990,1994, 1997, 2007, 2009).

Kepada yang berminat terhadap topik-topik di atas, silahkan kontak ke mspamulu@gmail.com untuk diskusi lebih lanjut. Terima kasih atas perhatiannya

1. Asset dan Kapabilitas Teknologi dalam hubungannya dengan keunggulan bersaing dan kinerja lestari perusahaan

2. Asset dan Kapabilitas Inovasi/Komplementer dalam hubungannya dengan keunggulan bersaing dan kinerja lestari perusahaan

3. Asset dan Kapabilitas Keuangan dalam hubungannya dengan keunggulan bersaing dan kinerja lestari perusahaan

4. Asset dan Kapabilitas Reputasi dalam hubungannya dengan keunggulan bersaing dan kinerja lestari perusahaan

5. Asset dan Kapabilitas Struktur dalam hubungannya dengan keunggulan bersaing dan kinerja lestari perusahaan

6. Asset dan Kapabilitas Institusional dalam hubungannya dengan keunggulan bersaing dan kinerja lestari perusahaan

7. Asset dan Kapabilitas Pasar/Posisi dalam hubungannya dengan keunggulan bersaing dan kinerja lestari perusahaan

Rencana penelitian ini merupakan lanjutan dari studi penelitian dari disertasi tentang manajemen strategik pada perusahaan konstruksi di Indonesia yang mengacu kepada paradigma strategi bisnis yaitu kapabilitas dinamis (dynamic capabilities framework) yang digagas oleh David Teece (1990,1994, 1997, 2007, 2009).

Kepada yang berminat terhadap topik-topik di atas, silahkan kontak ke mspamulu@gmail.com untuk diskusi lebih lanjut. Terima kasih atas perhatiannya

31 Januari 2011

Indonesia Infrastructure Report Q1 2011

Executive Summary

Indonesia’s construction industry value is expanding rapidly, a trend forecast to continue over our newly extended forecast period (2010-2020). This is being driven by investment into both transport and energy infrastructure, as well as industrial construction related to the country’s growing mining sector. In 2010 we are forecasting construction industry growth of 5.7%, and between 2011 and 2015 we are forecasting growth to average 7.2% per year. This quarter we have added a new section covering residential, commercial and industrial construction as well as social infrastructure.

Key factors facilitating growth:

• Indonesian government’s efforts to attract private investment into infrastructure. The government has employed a number of tools and enacted a variety of measures to facilitate investments and increase the number of public private partnerships (PPPs). Measures include the creation of the Indonesia Infrastructure Fund, designed to provide an alternative source of funding for infrastructure projects. Measures related to land issues are also being implemented, as land clearance is one of the major barriers to the country's investment climate.

• Strong and growing Foreign Direct Investment (FDI). FDI in Indonesia has grown substantially over recent years, from US$6bn in 2006 to US$10.8bn in 2009, according to the Indonesia Investment Coordinating Board. This trend looks set to continue in 2010, with first quarter figures rising by 41% year-on-year (y-o-y) to US$3.92bn. Strong sectors for investment continued to be the transport, storage and communications industry, which recorded US$941.5mn investment for 23 projects and the mining sector, which attracted US$711mn for 12 projects. Both of these sectors demand supporting infrastructure, and investment into the sectors has buoyed the construction sector.

• Substantial investment plan for the power sector by state owned utility PLN. PLN is enacting a two phase ‘crash programme’ to expand electricity generating capacity, with each phase adding 10,000MW of capacity. PLN was targeting investments of US$7.9bn in 2010 and a further US$9.8bn for 2011.

• Transport infrastructure is receiving substantial attention, specifically freight networks. With heavy investment into the mining sector, accompanying railways and ports are being developed to export coal. Billions of dollars of investments in railways have been pledged in 2010, driving transport infrastructure growth over the next five years.

Despite a strong outlook, a number of factors could undercut prospects for growth. The first is very high inflation in the construction sector, driven by rising construction materials prices. According to a recent study of 11 countries in Asia, Indonesia had the fourth highest cement price in the region. Indeed, a 50kg bag of cement in East Java costs almost double what it would in China, according to the Jakarta Post.

With cement costs accounting for around 30% of project costs, the impact is notable. The main reason for the higher prices has been blamed on transport and distribution costs, and the uncertain electricity supply in the country is bound to have an impact. There are also concerns of collusion between cement makers, limiting production to drive prices higher. High prices could erode real value creation and if costs run too high, projects could become unfeasible financially.

The other threat is the business environment. Although the Indonesian government is working hard to attract private investors, there is still an underlying threat of corruption and transparency in tendering infrastructure. This culminates in a score of just 54.6 out of 100 for infrastructure business environment and 35.8 out of 100 for project finance ratings.

Ref. © 2010 Business Monitor International: Indonesia Infrastructure Report Q1 2011

Indonesia’s construction industry value is expanding rapidly, a trend forecast to continue over our newly extended forecast period (2010-2020). This is being driven by investment into both transport and energy infrastructure, as well as industrial construction related to the country’s growing mining sector. In 2010 we are forecasting construction industry growth of 5.7%, and between 2011 and 2015 we are forecasting growth to average 7.2% per year. This quarter we have added a new section covering residential, commercial and industrial construction as well as social infrastructure.

Key factors facilitating growth:

• Indonesian government’s efforts to attract private investment into infrastructure. The government has employed a number of tools and enacted a variety of measures to facilitate investments and increase the number of public private partnerships (PPPs). Measures include the creation of the Indonesia Infrastructure Fund, designed to provide an alternative source of funding for infrastructure projects. Measures related to land issues are also being implemented, as land clearance is one of the major barriers to the country's investment climate.

• Strong and growing Foreign Direct Investment (FDI). FDI in Indonesia has grown substantially over recent years, from US$6bn in 2006 to US$10.8bn in 2009, according to the Indonesia Investment Coordinating Board. This trend looks set to continue in 2010, with first quarter figures rising by 41% year-on-year (y-o-y) to US$3.92bn. Strong sectors for investment continued to be the transport, storage and communications industry, which recorded US$941.5mn investment for 23 projects and the mining sector, which attracted US$711mn for 12 projects. Both of these sectors demand supporting infrastructure, and investment into the sectors has buoyed the construction sector.

• Substantial investment plan for the power sector by state owned utility PLN. PLN is enacting a two phase ‘crash programme’ to expand electricity generating capacity, with each phase adding 10,000MW of capacity. PLN was targeting investments of US$7.9bn in 2010 and a further US$9.8bn for 2011.

• Transport infrastructure is receiving substantial attention, specifically freight networks. With heavy investment into the mining sector, accompanying railways and ports are being developed to export coal. Billions of dollars of investments in railways have been pledged in 2010, driving transport infrastructure growth over the next five years.

Despite a strong outlook, a number of factors could undercut prospects for growth. The first is very high inflation in the construction sector, driven by rising construction materials prices. According to a recent study of 11 countries in Asia, Indonesia had the fourth highest cement price in the region. Indeed, a 50kg bag of cement in East Java costs almost double what it would in China, according to the Jakarta Post.

With cement costs accounting for around 30% of project costs, the impact is notable. The main reason for the higher prices has been blamed on transport and distribution costs, and the uncertain electricity supply in the country is bound to have an impact. There are also concerns of collusion between cement makers, limiting production to drive prices higher. High prices could erode real value creation and if costs run too high, projects could become unfeasible financially.

The other threat is the business environment. Although the Indonesian government is working hard to attract private investors, there is still an underlying threat of corruption and transparency in tendering infrastructure. This culminates in a score of just 54.6 out of 100 for infrastructure business environment and 35.8 out of 100 for project finance ratings.

Ref. © 2010 Business Monitor International: Indonesia Infrastructure Report Q1 2011

Langganan:

Postingan (Atom)